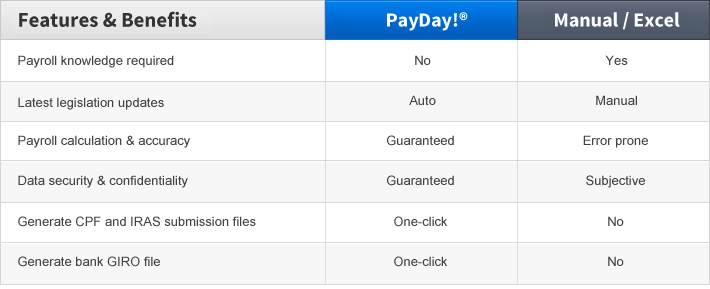

PayDay vs Manual / Excel

Disadvantages of Manual/Excel Payroll ManagementAre you processing your payroll manually or using Excel? Preparing for payday is a long, time-consuming and complicated process. Not only do you have to ensure that you're staying compliant with legislation and the latest updates, there's also the tedious process of payroll calculation and form filling. Not forgetting the fact that everything is done by hand. Then there's the problem of finding space to file all your documents and the challenge to maintain data security and confidentiality. But the greatest disadvantage of manual payroll systems is their propensity for errors. With so many calculations being performed manually, it's easy to make mistakes and doubly hard to correct them.

|

Payroll Knowledge

Singapore payroll regulations are updated regularly. For example, the CPF contribution rates for low-wage workers will be increased from 1 January 2014. As a result, private sector and government non-pensionable employees (including first and second year Singapore Permanent Residents) who are earning monthly wages of more than $50 to less than $1,500 will benefit from the changes. PayDay! SaaS captures the legislation changes automatically behind the scene, so payroll calculations comply with the latest regulation changes. Therefore, you are worry-free about non-compliant payroll.

Accuracy

Manual calculations increase the mistakes’ probability. Multiple times of payroll checking and / or an additional pair of eyes to go through the numbers are sometimes required to ensure accuracy. In contrast, PayDay! SaaS payroll experts make sure that it is 100% accurate.

Security and Confidentiality

Manual processing security and confidentiality is subjective. With PayDay! SaaS, only authorized personnel has the rights to login and process the monthly payroll. Furthermore, PayDay! SaaS data center is SSAE18 compliant and 256-bits SSL encryption technology is applied to ensure the best security for your data.

CPF, IRAS and Bank GIRO e-Submission Files

To business owners who process payroll themselves, form fillings are tiring, especially when it involves a larger number of employees. With PayDay! SaaS, this process is automated at a click. CPF, IR8A and GIRO e-submission files can be downloaded right after payroll has been processed.

You might also be thinking, “how can I use PayDay! SaaS to pay my employees?” PayDay! SaaS automatically generates your GIRO submission file which can be uploaded to your respective online banking portal.